Hello everyone

I just wanted to update you all on recent updates to content on the website, as by nature these will not always be obvious and it’s not a bad idea to let interested readers know what is going on.

The JC being mainly a “pull” resource, where you come and get what you want, rather than a “push” one, where I shove content into your inbox whether you want it or not, content-creation is a slow and accretive process (I described this in a previous newsletter which you can find here).

(Isn’t “content” an awful word, by the way? It has connotations of filling space.)

The way the JC works is very, very scatter brained. I add new things as I stumble across them, and then get distracted, follow my own honker down any rabbit hole that presents itself, and before long find myself writing cod Shakespeare about it. So it is hard to get anything done. But I know it will never be any different, so I have learned to go with it.

Anyway, here are some recent oubliettes and rabbit holes I have stumbled into — enjoy.

Olly

Emissions trading update

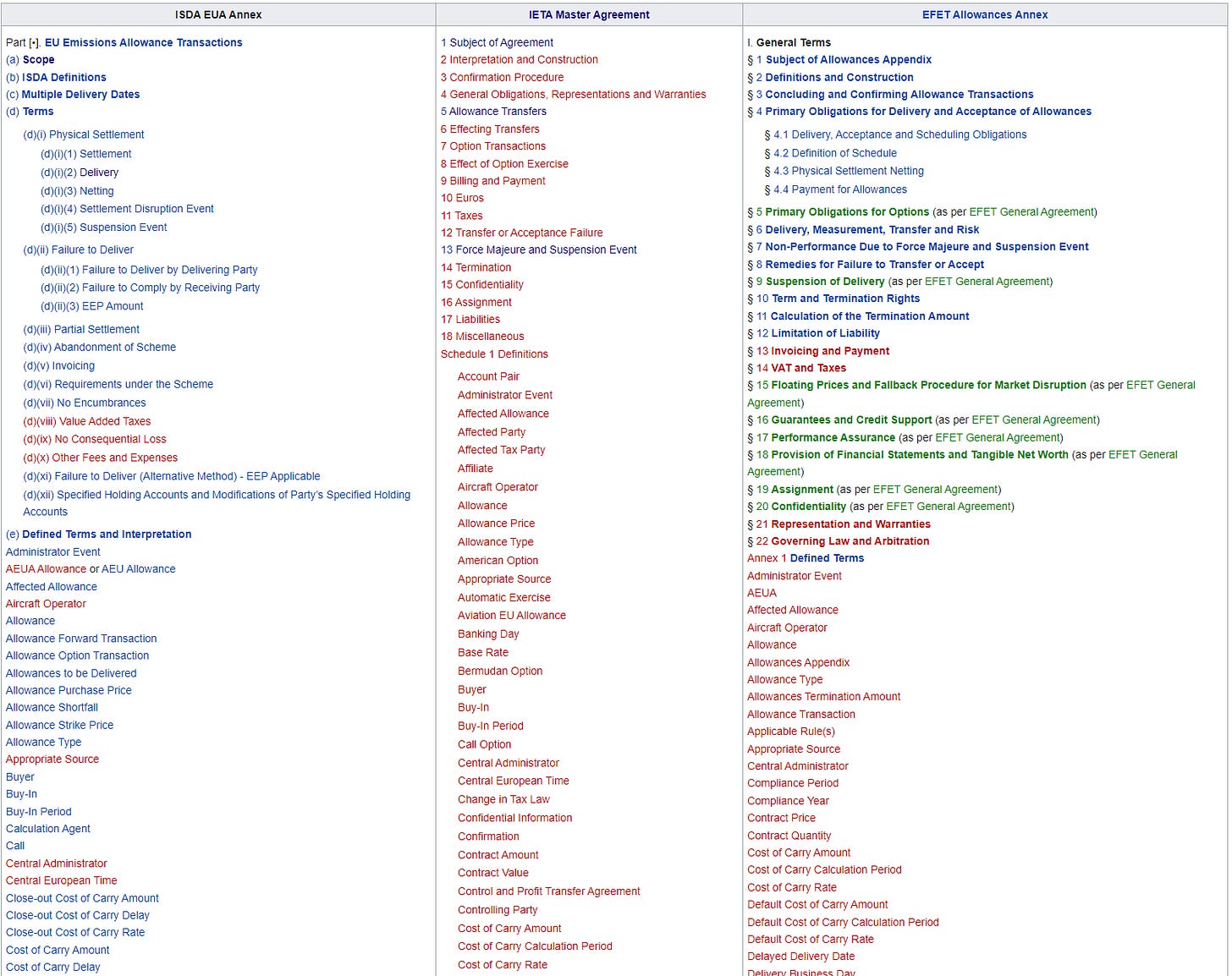

For reasons best known to the creator, recently the JC has been spending a lot of time looking at emissions allowance trading documentation. There are three main approaches to documentation: ISDA’s Allowance Annex, power and gas trading association EFET’s Allowance Appendix and specialist emissions association IETA’s master agreement. The three agreements are curiously similar in many regards — quite a bit of homework copying going on back in the day, by the looks of it — and curiously different in certain regards, some of which reflects the endemic neuroticism of each industry association. Swaps specialists are the most neurotic, power and gas traders the least, and specialist emissions people exist in a kind of utopian hippy midpoint).

A unique asset class

The emissions allowance is a fascinating, transgressive product. It challenges the traditional boundaries in finance. It is neither debt nor equity, and has no qualities of either: there is no credit exposure, and at least in some jurisdictions allowances cannot be pledged or held in trust, so they acquire the credit exposure of whomever you find to hold them on your behalf. In some ways they behave rather like a cash instrument: they represent an abstract value whilst having no intrinsic worth, can only be held, not owned, but unlike cash they expire, and before expiry can be redeemed — not for money, but for the release from an obligation to pay money.

Regulatory derivatives?

Emissions allowance trading schemes are a bit “Cnutish” in that they are a creature of unilateral government decree: the regulators declared that carbon polluters must submit these allowances, and so they did. In this way you can regard emissions trading as a form of pure, unadulterated regulatory derivative.

As financial instruments, emissions allowances are unusually susceptible to further government decree, which may at any time change their terms or eligibility for surrender, or abolish them altogether, as governments of different stripes wax and wane on how they feel about the environment. This is a lot less likely to happen to bonds or stocks. The risk increases the further into the future you look, meaning that the emissions market tends to trade over a short time-horizon of no more than a year or two. On the other hand, the forward curve is pretty steep, making it an attractive product to finance if you know how.

Documentation

Fraud, theft and tax

In its formative years the emissions market was also oddly vulnerable to fraud, theft and tax evasion — structural shortcomings that have long since been fixed — but there are a number of decidedly counter-intuitive features and disruption events in the documentation which probably have little use these days. Legal documentation dwells at length on the risks of theft of allowances from custody, in a way it tends not do when bonds and stocks are held in custody. This should subside over time.

It was just a dream

All of the documentation standards feature a seldom-seen economic close-out feature — present but never used in the 1992 ISDA master agreement, and never seen since — the “then I woke up and it was all a dream” close-out scenario, where if there is an incurable disruption scenario, at some point everyone just pretends the trade never happened and walks away. One needs to be careful when financing using the standard documentation suites, therefore.

Resources

the JC is building out anatomies of all three trading suite types, which you can access in table form here. The ISDA is largely done; the main fiddly bits of the EFET and the IETA are too — some of the more tiresome boilerplate will follow if we have a rainy spell or another COVID lockdown or something. We started out doing a UK emissions anatomy too, but it is basically the same as the EUA one for the time being, albeit even more at the mercy of governmental fiat.

Repackaging and secured MTNs update

The JC has also returned to an old stamping ground in the world of asset-backed securities: the repackaging programme. There was once a time where the JC’s alter ego was listed as the inventor of a repack programme in a formal patent application. It didn’t go anywhere, but it meant he could lie about his career for a while and sound more interesting at cocktail parties.

For reasons also best known to the creator, the JC is back in the trenches designing repackaging programmes again, as this has involved trying to persuade capital markets lawyers to move away from legal concepts and language that dated back from before the Sex Pistols, he has been obliged to get into the weeds of how medium term note programmes, and how secured, limited recourse note programmes, work.

They are not intuitive. Even seasoned professionals often struggle with fundamentals, like the role of security in the structure, and how the limited recourse is meant to work. so there is now a burgeoning repackaging anatomy, which you can access in the panel on the right by clicking the little triangle (the below is just a screenshot:

New laws of lexophysics

We like to keep ourselves at the forefront of the science of rent-seeking, as you know, so we are thrilled to be able to announce a newly-discovered law of worker entropy.

The JC’s sixteenth law of worker entropy, also known as the “law of conservation of tedium” states that:

The total amount of tedium in an isolated system remains constant. Tedium can be neither created nor destroyed; it can only be transformed from one form to another, or transferred from one system to another.

This is why all change management is doomed to fail, as one kind of tedium — having contract negotiators clogging up the premium floor-space on the London campus, for example — is replaced by another — engaging outsourcing co-ordinators, offshoring contract service level agreements, software-as-a-service providers and key performance indicators to then monitor them.

The total tedium gets worse, in fact, seeing as these change management techniques tend to expand the size of the isolated system, therefore increasing the available tedium. This fact, when Büchstein discovered it in the lab in 1943, finally explained the apparently paradoxical fact that tedium seems, all other things being equal, to increase over time.

Hitherto, it has been assumed that tedium must be a kind of anti-energy that just sort of hangs about in the atmosphere rusting things, like humidity — and that, over time a system just absorbs it. This was widely considered unsatisfactory, however, implying as it did some sort of lexophysical constant of undetectable anti-energy for which there was no evidence.

The first move towards a more sophisticated view came when, at a business day convention in 1930, lexophysicist J. M. F. Biggs proposed that, just as a physical system appears to “lose” energy through heat, light, friction without upsetting the fundamental law of conservation of energy, so a bureaucratic system gains tedium in a sort of compensating process, through the natural action of all bureaucratic operations, adding heat, friction, aggravation, resentment and ennui though incrementally spreading, without thereby upsetting the law of conservation of tedium.

A business process, Biggs hypothesised, naturally and inevitably acquires tedium through subtle and hard-to-measure but experimentally demonstrable increases in its size and complexity as bureaucrats act upon it.

It was not until twenty years that later Austrian polymath Otto Büchstein demonstrated that, just as Biggs had supposed, the law of conservation of tedium holds, but is more profoundly affected than had previously been thought, by the size of the system. The amount of tedium in a given system, Büchstein argued, is a square of the number of individuals comprising that system.

This has since become recognised as the seventeenth law of worker entropy.

Playlist of the week

To celebrate their recent performance of the album, with the Liverpool Philharmonic Orchestra at the Royal Albert Hall, this week it is Echo and the Bunnymen’s magnificent Ocean Rain.

And there follows a few nature notes and queries for our special premium subscribers of whom anyone can be one, for less than the cost of half a pint (admittedly, at a poshed-up North London watering hole of the sort the JC frequents) a week!

Keep reading with a 7-day free trial

Subscribe to The Jolly Contrarian to keep reading this post and get 7 days of free access to the full post archives.